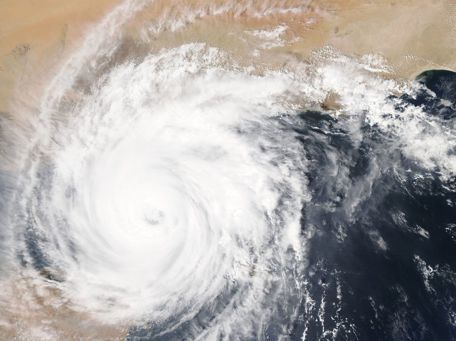

Is Your Home Ready for Hurricane Season?

State Fund Insurance • May 4, 2020

Hurricane activity peaks in the fall, but severe windstorms can occur at any time of year. The following pointers can help you protect your property.

Preparation Checklist:

• Know your surroundings.

• Learn the elevation level of your property and whether the land is flood-prone. This will help you know how your property will be affected when storm surge or tidal flooding are forecasted.

Identify levees and dams in your area and determine whether they pose a hazard.

Make plans to secure your property:

• Cover all of your home's windows. Permanent storm shutters offer the best protection for windows.

• Be sure trees and shrubs around your home are well trimmed so they are more wind resistant.

• Clear loose and clogged rain gutters and downspouts.

• Reinforce your garage doors; if wind enters a garage it can cause dangerous and expensive structural damage.

• Bring in all outdoor furniture, decorations, garbage cans and anything else that is not tied down.

• Determine how and where to secure your boat.

• Install a generator for emergencies.

• If in a high-rise building, be prepared to take shelter on a lower floor and in a small interior room without windows when it’s windy. Wind conditions increase with height. When flooding may be occurring, be prepared to take shelter on a floor safely above the flooding and wave effects.

• Consider building a safe room.

After a hurricane or windstorm:

• If you evacuated, return home only when officials say it is safe.

• If you cannot return home and have immediate housing needs, text SHELTER + your ZIP code to 43362 (4FEMA) to find the nearest shelter in your area. FEMA also offers assistance for those who have longer-term housing needs.

• Drive only if necessary and avoid flooded roads and washed-out bridges. Stay off the streets. If you must go out watch for fallen objects; downed electrical wires; and weakened walls, bridges, roads and sidewalks.

• Keep away from loose or dangling power lines and report them if possible.

• Walk carefully around the outside of your home and check for loose power lines, gas leaks and structural damage before entering.

• Inspect your home for damage. Take pictures of damage, both of the building and its contents, for insurance purposes. If you have any doubts about safety, have your residence inspected by a qualified building inspector or structural engineer before entering.

• Use battery-powered flashlights in the dark. Note: The flashlight should be turned on outside before entering — the battery may produce a spark that could ignite leaking gas, if present.

• Watch your pets closely and keep them under your direct control. Watch out for wild animals, especially poisonous snakes. Use a stick to poke through debris.

• Avoid drinking or preparing food with tap water until you are sure it's not contaminated.

• Check refrigerated food for spoilage.

• Wear protective clothing and be cautious when cleaning up to avoid injury.

©2012 SmartsPro Marketing. tel. 877-762-7877 • www.smartspromarketing.com

©2012 SmartsPro Marketing. tel. 877-762-7877 • www.smartspromarketing.com

Homeowners insurance is essential in protecting your valuable investment. It safeguards you from potential financial setbacks resulting from unforeseen events like fires, theft, and natural disasters. While shopping for a homeowners policy, you may come across the term 'deductible.' Let's delve into why choosing a higher deductible might be a smart decision for many homeowners. 1. What is a Deductible? A deductible is the amount of money you pay out-of-pocket for a covered loss before your insurance kicks in. For instance, if your home sustains $10,000 in damages and your deductible is $1,000, you'll pay the first $1,000, and State Fund Insurance will cover the remaining $9,000. 2. The Relationship between Deductible and Premium A crucial point to understand is the inverse relationship between the deductible and the premium. The premium is the amount you pay for your insurance policy, usually monthly or annually. Generally, the higher the deductible you choose, the lower your premium becomes. Conversely, a lower deductible often means a higher premium. 3. Why Consider a Higher Deductible? a. Reduced Premiums: As previously mentioned, a higher deductible can significantly lower your insurance premiums. Over time, these savings can add up, helping you manage your monthly expenses better. b. Fewer Claims: With a higher deductible, you're more likely to cover minor repairs and damages out-of-pocket instead of filing a claim. Fewer claims can mean better rates in the future, as insurance companies often increase premiums after claims. c. Prevents Small Claims: Several small claims can lead to higher insurance rates and even cancellation, or non renewal. By having a higher deductible, you're less likely to file a claim for minor damages, ensuring your rates remain stable. d. Builds Financial Discipline: Knowing you have a higher deductible might motivate you to set aside an emergency fund. This financial discipline is invaluable not just for potential insurance claims but for other unexpected expenses too. 4. Is a Higher Deductible Right for Everyone? While there are clear benefits to choosing a higher deductible, it's essential to evaluate your financial situation. Ensure you can comfortably afford the deductible amount in the event of a claim. If you're living paycheck-to-paycheck, a higher deductible might pose challenges. In Conclusion Taking a higher deductible on your homeowners policy can be a sound financial decision, contact State Fund Insurance for money saving options, especially if you're looking to reduce premiums. However, it's essential to choose a deductible that aligns with your financial capability. Consult with a State Fund Insurance agent to find the perfect balance that suits your needs.

Increased Cost of Construction How old is your home? Any building more than a few years old might not comply with current building codes. And that can create problems. When property damage forces you to rebuild or remodel, you most likely will have to bring your construction up to current building codes. Most homeowners policies exclude coverage for loss due to complying with an ordinance or law regulating construction, repair or occupancy of any building. So even if your home is properly insured to value, your policy might not cover the additional costs of bringing it up to current codes. To make matters worse, after a portion of your home is damaged, local authorities can require you to repair undamaged portions to bring them up to current codes. And since remodeling usually costs more on a square-foot basis than new construction, these repairs can be costly. Debris Removal If your home is destroyed or damaged, you’ll probably have some trash and debris to remove before repairs can begin. Will your insurance policy cover these costs? The typical homeowners property policy provides debris removal coverage as an “additional coverage” over and above your property policy’s limits. It will pay the cost of removing “covered property” damaged by a “covered cause of loss.” Sometimes a policy will include an additional debris removal limit—check the policy declarations. If the total of the direct physical loss costs and debris removal costs exceeds your policy limits, or if debris removal expenses exceed the debris removal “additional coverage” limits, some policies will provide an additional cost in debris removal coverage per incident. This additional coverage often applies in areas where storm damage is common. ©2012 SmartsPro Marketing. tel. 877-762-7877 • www.smartspromarketing.com

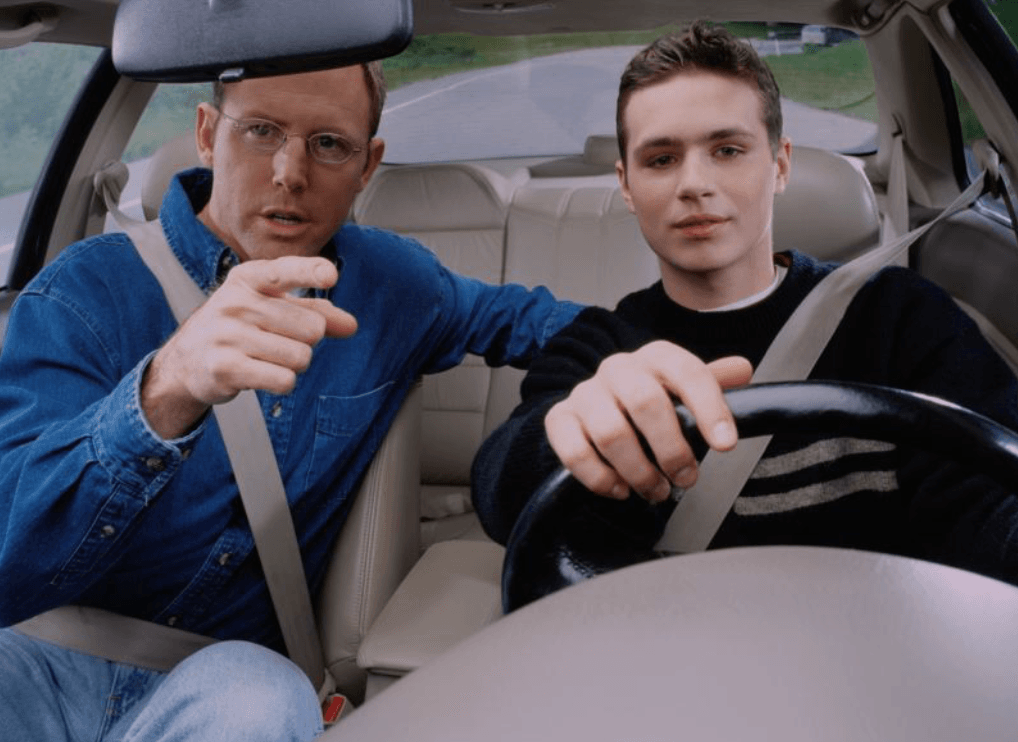

DOWNLOAD PAMPHLET: "Hands-Free While Driving" from mass.gov This pamphlet provides an excellent overview of what the new law means for drivers under and over age 18, and the consequences they’ll face for breaking the law. To summarize the key points… Drivers 18 and over: Can ONLY use electronic devices and mobile phones in hands-free mode CANNOT touch phone except to activate the hands-free mode or enable GPS, and then ONLY if the device is installed or properly mounted to the windshield, dashboard, or center console in a manner that does not impede the operation of the motor vehicle. CANNOT touch the device for texting, emailing, apps, video, or internet use Can use voice-to-text communication to electronic devices ONLY when device is properly mounted; use of headphone (one ear) is permitted. Handheld use is allowed ONLY if the vehicle is both stationary and not located in a public travel lane. Handheld use is NOT allowed at red lights or stop signs Drivers under 18 are not allowed to use any electronic devices. All phone use while driving is illegal, including use in hands-free mode. In an Emergency: Operators may use a cell phone to call 911 to report an emergency. If possible, safely pull over and stop before calling 911. ©2012 SmartsPro Marketing. tel. 877-762-7877 • www.smartspromarketing.com

• Coach your son or daughter. Talk openly and frankly with your teenager in order to determine his or her attitude about being behind the wheel. Work with your teen to set ground rules, such as the number of people allowed in the car, where the car may be taken, and curfew. • Make sure you know the rules of the road. Some states have more restrictive rules for underage drivers. Most have curfews that prohibit drivers under the age of 18 from operating a vehicle between certain nighttime hours. Some will waive these restrictions after the teen has had his/her license for a specified time. • Use emergency road service. If you do not belong to a motor club, consider joining one that provides 24-hour emergency road service. That way, teenagers may call for help at any time if they need gas, need a jump-start, are locked out or need a tire changed. You can also arrange with the motor club to provide service for your teen if they are in a friend’s car. • Understand the real hazards facing teen drivers. Contrary to popular belief, most serious accidents involving teens were not caused by aggressive driving, risk-taking or even drowsiness. Seventy-five percent of accidents studied by The Children’s Hospital and State Farm involved a “critical error” in judgment that led up to the crash. The study identified the three most common such errors as lack of scanning needed to detect and respond to hazards, going too fast for road conditions, and being distracted. • When your son or daughter gets a driver’s license, contact us so we can review your insurance options with both of you. It is important for you — and your son or daughter — to remember that, yes, your auto insurance rates will go up, but they will come down after he or she gains a couple years of driving experience. However, your rates will really go up if your teenager has tickets or gets into accidents. • Some states prohibit underage drivers from having other minors as passengers. And many restrict or prohibit the use of cell phones while driving. ©2012 SmartsPro Marketing. tel. 877-762-7877 • www.smartspromarketing.com